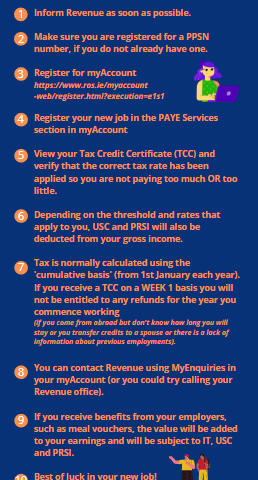

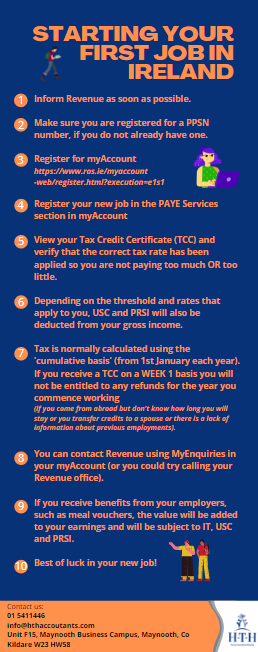

- Inform Revenue as soon as possible.

- Make sure you are registered for a PPS Number, if you do not already have one.

- Register for myAccount.

- Register your new job in the PAYE Services section in myAccount.

- View your Tax Credit Certificate (TCC) and verify that the correct tax rate has been applied so that you are not paying too much OR too little.

- Depending on the threshold and rates that apply to you, USC and PRSI will also be deducted from your gross income.

- Tax is normally calculated using the ‘cumulative basis’ (from 1st January each year). If your receive a TCC on a WEEK 1 basis you will not be entitled to any refunds for the year you commence working. (If you come from abroad but don’t know how long you will stay or you transfer credits to a spouse or there is a lack of information about previous employers)

- You can contact Revenue using MyEnquiries in your myAccount (or you could try calling your Revenue office).

- If you receive benefits from your employer such as meal vouchers, the value will be added to your earnings and will be subject to IT USC and PRSI.

- Bet of luck in your new job!