What is it?

Automatic Enrolment is a new savings and investment scheme for employees where financial returns are paid out to participants on retirement, in addition to the State Pension.

Why is it being set up?

Not enough people have occupational or supplementary pension coverage to help maintain a reasonable standard of living in retirement above the level of the State Pension.

Who will be automatically enrolled?

Approximately 750,000 employees who are aged between 23 and 60, earning over €20,000 across employments and who are not already enrolled in an occupational pension scheme.

How much will it cost?

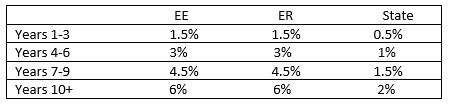

Contributions will be paid by employees and matched by their employers as a percentage of the employees gross income. The state will top up the rest. The rates of contribution will be phased in gradually over a decade as follows:

Employer contributions and the state top up will be capped at a maximum of €80,000 of an employees gross salary. Employees may contribute on earnings greater than €80,000 if they wish. One off contributions into the scheme are not allowed.

Will it be possible to leave the system?

Opting out or suspending participation is possible under certain circumstances.

How will it be managed?

A central processing authority will be set up to ensure the best interests of participants and will:

- Administer the system on behalf of enrolled employees, their employers and the state.

- Collect, pool and distribute contributions to commercial investment managers.

- Collect, pool and distribute financial investment returns to participants.

- Operate an online accounts portal where participants can see their savings pot grow.

- Facilitate a pot-follows member system whereby participants will benefit form owning one single AE pension pot across employments and throughout their working lives.

- Sets standards for the commercial registered providers of AE investment products.

How will the investment work?

There will be a well balanced and diversified default investment fund, plus three other fund options for employees who want to invest their money at different levels of risk. To note the tax relief for employees on current pension arrangements is at their marginal rate, ie 20% or 40%. The proposed auto enrolment state subsidiary is 33% of employee contributions and this isequivalent to tax relief of 25% only. Auto enrolment is better for low earners who are taxed at 20%, anyone in a higher tax bracket will be better off setting up a pension now in the existing pension schemes that are available – PRSA, AVC etc.