As part of Budget 2022, the government set out the future direction of EWSS including its graduated, structured and orderly exit strategy. These arrangements were subsequently enhanced in response to the public health situation in December 2021, and the subsequent extension of the enhanced rates of subsidy for a further two months (across December 2021 and January 2022). The reopening of the scheme for certain businesses were announced on 9 and 21 December 2021 respectively. (See below)

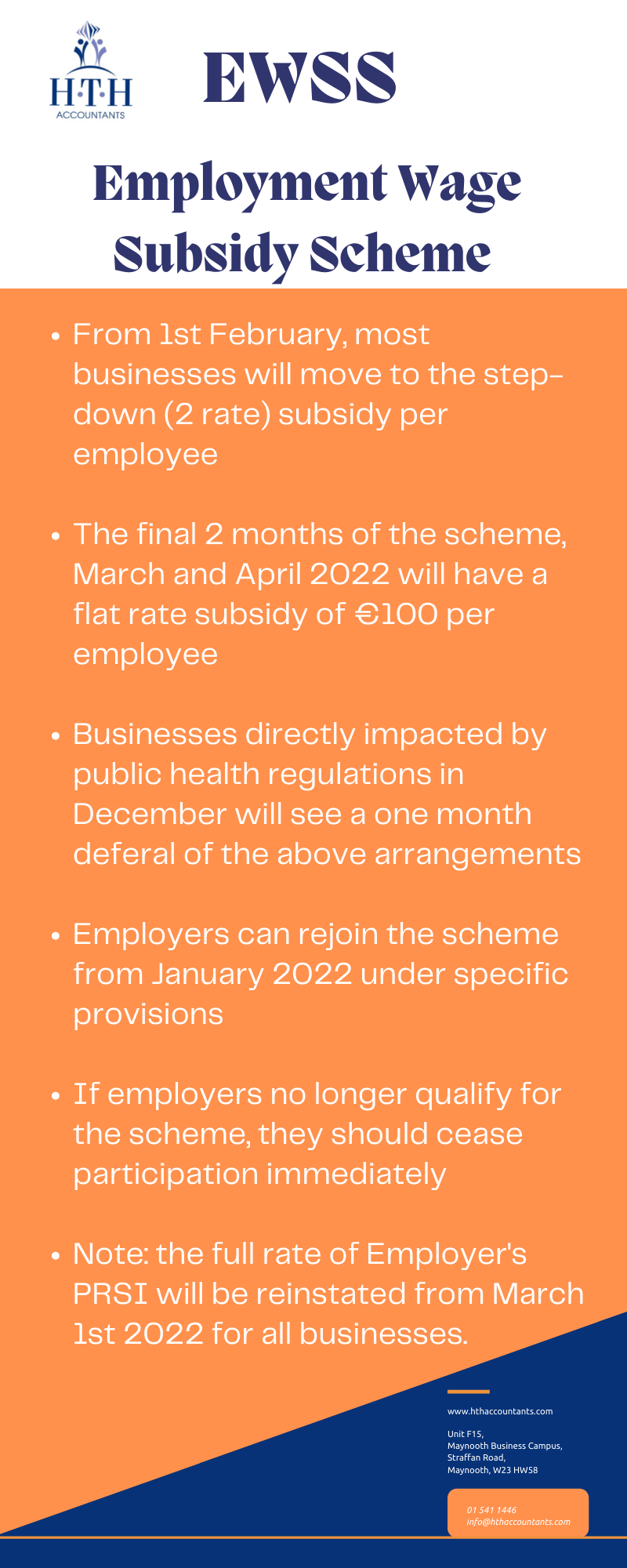

On 21 January 2022 Minister Donohoe confirmed that from 1 February 2022, most businesses, apart from those that were directly impacted by the public health restrictions introduced in December 2021, will move to the step-down two-rate subsidy (€151.50 and €203) per employee, followed by the flat rate subsidy of €100 per employee for the final two months the scheme of March and April 2022. The scheme will end on 30 April 2022. These arrangements will apply to most businesses.

Businesses that were directly impacted by the specific terms of the public health regulations introduced last December, e.g. 8pm closing and venue capacity, will see a one-month deferral to the above arrangements. As they fully reopen and emerge from the restrictions, such businesses will continue to receive the enhanced rates of subsidy for a further month (February 2022), the original two-rate subsidy will apply for one month (March 2022), followed by the flat rate subsidy of €100 for a further two months (April and May 2022).

The extension to the Employment Wage Subsidy Scheme (EWSS) to support those businesses and a number of clarifications in relation to the Covid Restrictions Support Scheme (CRSS) and Tax Debt Warehousing Scheme were agreed by Government and will be addressed by primary legislation in the coming weeks.

Employers can re-join the scheme from January 2022 provided they:

- previously correctly claimed support under EWSS, and

- anticipate that their accumulated turnover for December 2021 and January 2022 will be down by at least 30% compared with the combined turnover for December 2019 and January 2020 (or for businesses established between 1 May 2019 and 31 December 2021 the average monthly turnover for December 2021 and January 2022 is down by at least 30% when compared to the average monthly turnover across the period August 2021 to November 2021).

For businesses who continued to qualify up until 31 December there is nothing additional that they are required to do, apart from completing one last ERF form for December 2021. They will continue to claim the EWSS up until 30 April 2022.

It should be noted that the full rate of Employers’ PRSI will be reinstated with effect from 1 March 2022 for all businesses, as announced in Budget 2022 and legislated for in the Social Welfare Act 2021.

Tax Debt Warehousing Scheme

In relation to the Tax Debt Warehousing Scheme, and the decision by Government last month, to extend the period where tax liabilities arising can be warehoused to the end of Q1 2022, for all taxpayers eligible for COVID-19 support schemes, it has now been agreed that this date will be extended to 30 April 2022 to facilitate the two monthly VAT return for March/April.