Let’s keep it simple: If it’s wholly and exclusively for the business, there is a good chance you can write it off for tax purposes. But that doesn’t mean everything you buy while running a business is tax deductible.

We get asked this question every week, so here’s a simple guide to what you can and can’t claim.

First, what is a business expense?

A business expense is anything you spend money on for the day-to-day running of your business.

If Revenue sees it as necessary to earning your income, it’s generally allowable.

That means it can reduce your tax bill — but only if:

- It’s used for business purposes, and

- You keep a receipt (or record) for it.

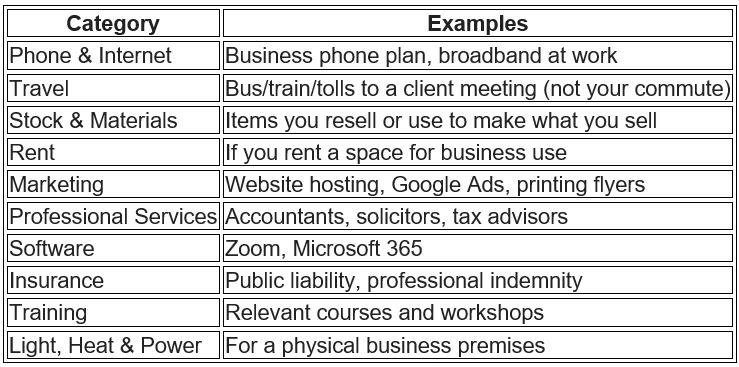

10 Common Business Expenses You Can Write Off

Here’s what most self-employed people and small companies claim:

What About Home Office Costs?

If you run your business from home, you may be able to claim a portion of your household bills. However this depends on the following:

- The amount of time you work from home, and

- Whether the space is exclusively used for business (e.g. a dedicated office vs. the kitchen table)

What can be claimed?

You may be able to write off a reasonable portion of:

- Electricity and heating

- Broadband

- Rent (if applicable – e.g. a larger property is being rented in order to facilitate the home office)

- Home insurance (partially, where relevant)

Limited company directors:

Your company can pay you a flat-rate e-working allowance of up to €3.20 per day (tax-free) if you regularly work from home. However, this must be properly recorded and the company must have a physical office separate from your home.

You can’t claim mortgage interest or rent via the company directly.

How much can I claim?

There’s no fixed rate. However Revenue expects it to be reasonable and justified.

Example:

If one room out of five is used as an office, that’s 20%.

If it’s only used half the week, your allowable portion may be 10%.

Keep clear records. Don’t stretch the claim unless you’ve got the space and usage to back it up.

What About Cars and Mileage?

If you use your personal car for business (e.g. site visits, meetings):

- You can claim mileage at Revenue’s approved rates (once certain conditions are met),

OR - You can claim a proportional share of actual car expenses (fuel, insurance, maintenance)

But remember:

You cannot claim for commuting i.e. driving from home to your regular office isn’t a business journey, even if you’re self-employed.

Common Expenses You Can’t Write Off

Let’s clear this up, as these are often asked about but not claimable for tax:

- Your own wages or drawings (if you’re a sole trader)

- Normal clothes (unless it’s safety gear or a branded uniform)

- Lunch you buy for yourself

- Parking fines or penalties

- Family holidays (even if you checked emails)

What About Receipts?

You must keep receipts or proper records for all your expenses.

You have can have as sophisticated or as simple a process as you like.

This helps to keeps you audit-ready.

Final Tip: When in Doubt…

Ask yourself:

Would I have bought this if I wasn’t running a business?

If the answer is no, there’s a good chance it’s allowable.

If it’s yes, check the rules or run it by us.

Want help getting your expenses in order?

If you’d like help managing your accounts, or staying compliant, get in touch with us at HTH Accountants — we’re here to help and to make it simple!